30+ debt to.income ratio mortgage

Web In January 2023 FHFA announced redesigned and recalibrated grids for upfront fees in addition to a new upfront fee for certain borrowers with a debt-to-income. Web How much debt is acceptable for a mortgage.

Section 1 Shocks To The Financial System Chart 1 1 Gdp Growth Forecasts Source Imf World Economic Outlook Ppt Download

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

. But each mortgage lender can set its own eligibility requirements and DTI. Get Instantly Matched With Your Ideal Home Loan Lender. For example if your monthly pre-tax income.

Web You can get an estimate of your debt-to-income ratio using our DTI Calculator. Calculate Your Monthly Loan Payment. Ad See If Youre Eligible for a 0 Down Payment.

Get Started Now With Quicken Loans. A DTI of 43 is typically the highest. Web In general lenders prefer that your back-end ratio not exceed 36.

Apply Now With Quicken Loans. Web Generally a good debt-to-income ratiois around 36 or less and not higher than 43. Web Your debt-to-income DTI ratio is the percentage of gross income before taxes are taken out that goes toward your debt.

Web Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly income. Youll usually need a back-end DTI ratio of 43 or less. Web If your housing-related expenses are 1000 and your gross monthly income is 3000 your front-end DTI would be 33 10003000033.

If your home is highly energy-efficient. Get Started Now With Quicken Loans. Apply Now With Quicken Loans.

Web To calculate your debt-to-income ratio add up your total recurring monthly obligations such as mortgage student loans auto loans child support and credit card. Compare Mortgage Options Get Quotes. Ad Compare Mortgage Options Calculate Payments.

50 is a common limit but some lenders are more cautious. Apply Online Get Pre-Approved Today. Ad Compare Best Mortgage Lenders 2023.

Web Here are debt-to-income requirements by loan type. Answer Simple Questions See Personalized Results with our VA Loan Calculator. Compare Mortgage Options Get Quotes.

Most lenders will lend below 100 debt-to-income ratio. Web How to calculate your debt-to-income ratio. Ad Compare Mortgage Options Calculate Payments.

Choose a longer time period to pay off your. The most common term for a mortgage is 30 years or 360 months but different. Web The debt-to-income DTI ratio measures the amount of income a person or organization generates in order to service a debt.

Compare Now Find The Lowest Rate. Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments. Ad Use Our Comparison Site Find Out How to Get Home Loan Pre Approval In Minutes.

That means if you earn 5000 in monthly gross income your total debt obligations should be. Web Web Calculating your DTI Ratio Simply enter your monthly gross income pre-tax and your monthly debt expenses into the calculator below to find out your DTI ratio. Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis.

To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments.

What Is A Good Debt To Income Ratio For A Mortgage Eric Wilson

Mortgage Guidelines On Late Payments In The Past 12 Months

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

![]()

5 Factors That Affect Your Mortgage Application Homewise

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Debt To Income Ratio Calculator Nerdwallet

15 Vs 30 Year Mortgage Which Is The Best Choice White Coat Investor

Calculated Risk Update Household Debt Service Ratio At Lowest Level In 30 Years

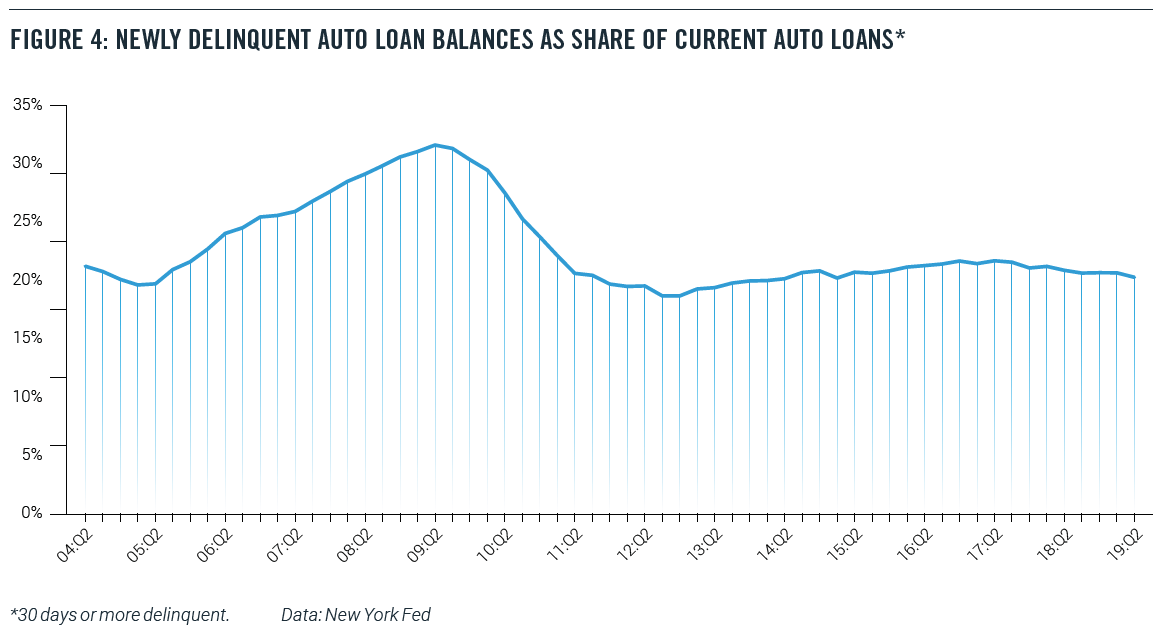

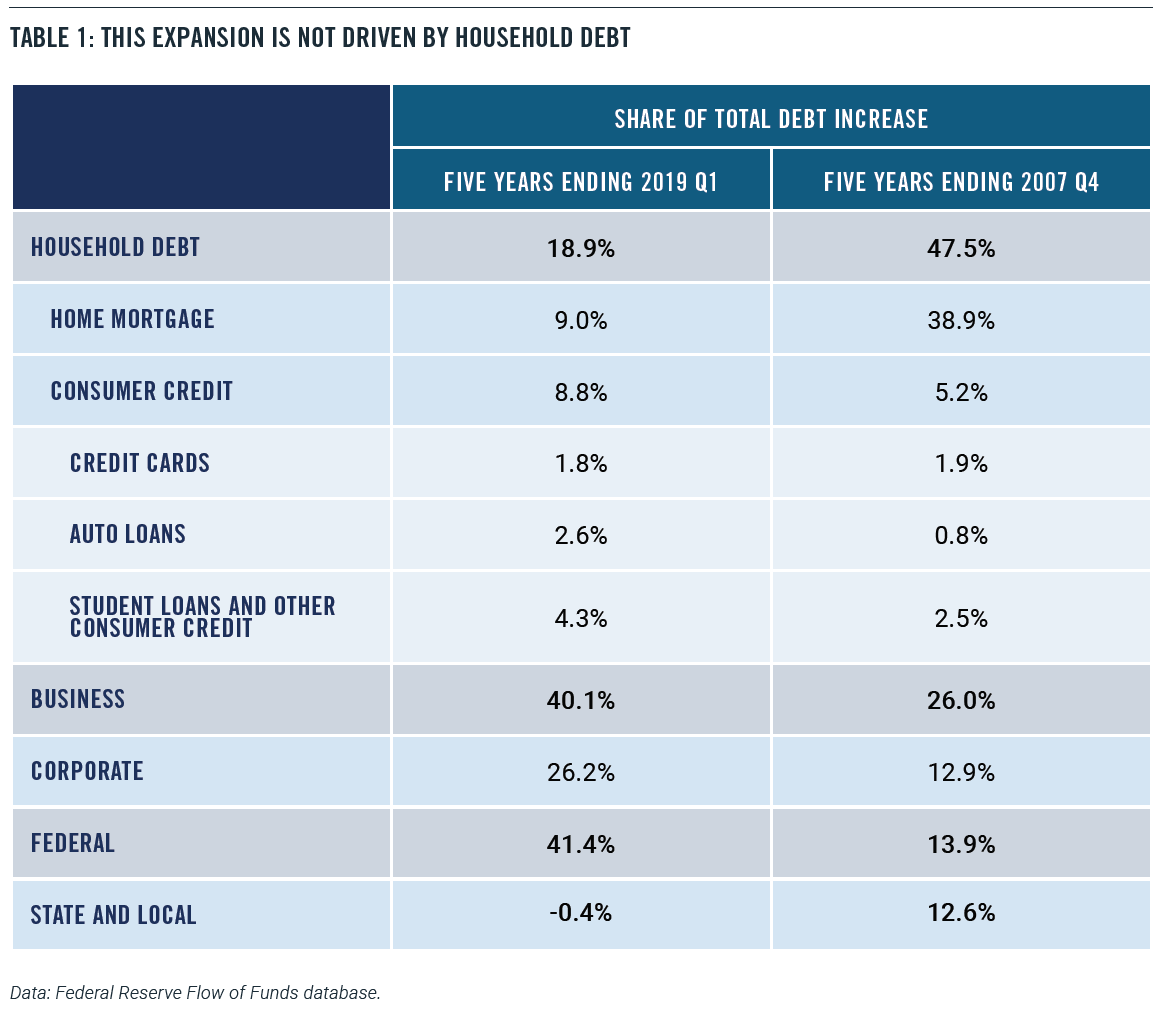

Low Income Borrowers And The Auto Loan Market Aaf

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

What Is A Good Debt To Income Ratio For A Mortgage Eric Wilson

Rising Council Debt Across New Zealand

Predicting Loan Repayment Introduction By Imad Dabbura Towards Data Science

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

Low Income Borrowers And The Auto Loan Market Aaf

Gabriel Pena Mortgage Loan Advisor

Calculated Risk Fed Household Debt Service Ratio Near Lowest Level In 30 Years